MEP Giants insights

- The 2025 MEP Giants show a 25% year-over-year drop in engineering headcount, likely driven by mergers and acquisitions, retirements outpacing new hires, offshoring, weaker commercial design demand and high borrowing costs.

- Private equity reshuffling and cost controls may be trimming staff while artificial intelligence’s effect remains uncertain.

For the 2025 MEP Giants, one number stood out to me: Firms employed 25% fewer engineers than they did last year. While a dozen companies are new to the list this year, causing shifts in numbers, the percentage drop is huge. It’s not a margin of error anomaly, a statistical blip or anything else. It’s a definite shift.

So, what’s causing this huge drop?

One of the first things to check is mergers and acquisitions. This year, one-fifth of firms reported acquiring another company. That’s a slight dip from last year, though the size of the company may have made a difference. If a merger caused significant overlap in a geographic market or engineering specialty, then staff may have been eliminated.

Shifts in the job market have also occurred in various industries. This is due, in part, to baby boomers reaching retirement age and leaving the workforce, without an equal number of entry-level engineers replacing them. Plus, engineering jobs may be moving overseas, reducing the number of engineers reported by the MEP Giants.

Commercial building design activity has weakened in many sectors, including office buildings, which is frequently the No. 1 building type where MEP Giants earn design or retrofit fees. Overall construction starts trailed year-ago levels on a year-to-date basis, trimming near-term backlog conversion.

Artificial intelligence (AI) was not part of this MEP Giants data collection process, but the topic has come up in several other studies as a concern for engineers. Will AI take away jobs? Will it streamline practices and remove busy work? How many MEP Giants firms employ AI in their daily work?

Private equity has been purchasing several firms and quietly readjusting the number of employees. This cost control can be found in every sector, not just engineering. The long-term cost of reducing the number of expert engineers might not be felt for a few years.

Elevated financial rates keep debt costs high, delaying private building projects and reducing the need for engineers to work on new construction projects. Tighter lending, municipal bond shifts and other financial factors all play into this.

It’s also possible that misrepresented numbers may impact results, though each firm has the opportunity to check its numbers before final submission. Plus, if a significant change occurs anywhere, we flag it and ask questions.

Nothing in the above list is mutually exclusive. It might be a combination of factors that affect the number of engineers at each firm. While we cannot determine the exact formula each engineering company uses in its hiring practices, we can watch overall employment numbers at these top companies.

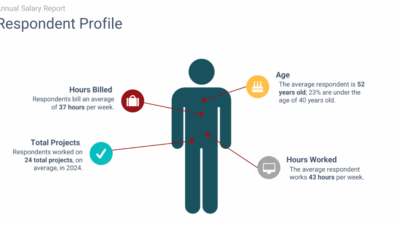

Stay tuned as we ask more questions and look at this more closely in upcoming studies, including the annual Career & Salary Report.