Lifecycle cost analysis (LCCA) is a tool used to determine the most cost-effective option among HVAC system alternatives.

Learning objectives

- Understand basic lifecycle cost analysis (LCCA) concepts and best practices.

- Learn to incorporate LCCA into an HVAC system selection process.

- Identify tools that simplify LCCA calculation and results documentation.

Practically speaking, there are multiple building design options that can meet programmatic needs and achieve acceptable levels of performance. From a purely financial perspective, the only appropriate design alternative is the solution that satisfies the owner’s project requirements for the lowest total cost of ownership. Lifecycle cost analysis (LCCA) is a powerful tool used to determine the most cost-effective option among competing alternatives. Although LCCA has been used for decades to reliably identify cost-optimal design solutions, many building owners and architecture and engineering professionals still rely on simple payback to make project investment decisions.

LCCA is an economic method of project evaluation in which all costs arising from owning, operating,maintaining, and ultimately disposing of a project are considered to be potentially important to that decision. LCCA is particularly suitable for the evaluation of building design alternatives that satisfy a required level of building performance (including occupant comfort, safety, adherence to building codes and engineering standards, and system reliability), but may have different operating, maintenance, and repair (OM&R) costs, and potentially different useful lives.

Project-related costs that occur at different points in time cannot be directly combined for meaningful economic analysis because the dollars spent at different times have different values to the investor. LCCA provides a rational means to weigh the value of first costs versus future (e.g., operating) costs (see Equation 1).

Adjusting to present value

Most individuals intuitively recognize that a dollar today does not have the same value as a dollar in the distant future. This concept, referred to as the time value of money, results from two considerations: 1) general inflation, which is the erosion of future purchasing power; and 2) opportunity cost, which for existing capital is the cost of forgone investment opportunities and for borrowed capital is the cost of borrowing (i.e., the loan rate). Lifecycle costing considers both effects in weighing the value of present costs against future costs.

General inflation and price escalation: General price inflation measures the decline in the purchasing power of the dollar over time. LCCA methodology provides two approaches for dealing with general price inflation: current dollar analysis and constant dollar analysis. Current dollars are dollars of any 1 year’s purchasing power, inclusive of inflation. That is, they reflect changes in the purchasing power of the dollar from year to year. In contrast, constant dollars are dollars of uniform purchasing power, exclusive of inflation. Constant dollars indicate what the same good or service would cost at different times if there were no change in the general price level (no general inflation or deflation) to change the purchasing power of the dollar.

In general, LCCA calculations for building systems should treat general price inflation using a constant dollar approach. The constant dollar approach has the advantage of avoiding the need to project future rates of inflation or deflation, which adds unnecessary complexity and uncertainty. The price of a good or service stated in constant dollars is not affected by the rate of general inflation. For example, if the price of a piece of equipment is $1,000 today and $1,050 at the end of a year in which prices in general have risen at an annual rate of 5%, the price stated in constant dollars is still $1,000; no inflation adjustment is necessary. In contrast, if cash flows are stated in current dollars, future amounts include an assumed general inflation rate and an adjustment is necessary to convert the current-dollar estimate to its constant-dollar equivalent.

Few commodities have prices that change at exactly the rate of general inflation year after year, but many commodities have prices that change at a rate close to that of general inflation over time. Maintenance and repair costs and construction materials tend to follow general price inflation, while utility prices tend to be much more volatile. Typically, LCC methodology assumes that prices for all goods and services, other than for energy and water, will increase at approximately the same rate as general inflation. However, if there is a documentable basis for assuming that prices change at a rate different than general inflation(e.g., when price escalation rates are established in a maintenance contract), these rates can be used in the analysis.

While goods and services are assumed to inflate at the same rate (i.e., the general inflation rate), LCC procedures require that inflation of energy prices be treated separately. In other words, this assumes that energy prices will not inflate at the same rate as other goods and services. Accordingly, we distinguish general price inflation from energy price inflation by referring to the latter as energy price "escalation." As with the use of the discount rate, the energy price escalation rates are "real" (i.e., net or differential).

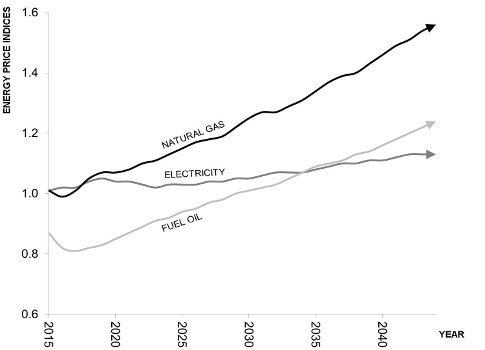

The U.S. Energy Information Administration (EIA) publishes official projections for future energy prices annually each April for the residential, commercial, and industrial sectors broken down by region of the country for six energy types (electricity, natural gas, propane, distillate fuel oil, residual fuel oil, and coal).Figure 1 illustrates how the Dept. of Energy projects national average electricity, fuel oil, and natural gas prices are expected to move over the next 30 years in real dollar terms. These fuel escalation rates are suitable for most building-related LCCA studies. If using alternative escalation rates, be sure to use "real"rates that indicate how energy prices will increase above and beyond general price inflation (Note that

Equation 4 may also be used to convert a "nominal" escalation rate into a "real" escalation rate).

Given a present price and a real escalation rate Equation 2 may be used to determine an escalated future price. For example, assume the present price of natural gas is $1.00 per therm and that the price of natural gas is anticipated to escalate at a constant rate of 5%. At the end of year-10 natural gas will cost$1.63 per therm. In all likelihood, general price inflation will drive the actual price of natural gas higher than $1.63 per therm in year-10. However, constant dollar analysis focuses on incremental price change for energy by using "real" escalation rates. Note that this escalated price ($1.63) may not be used in Equation 1 until it is discounted to present value using Equation 3.

Opportunity costs and discount rates: Opportunity costs recognize that a fair comparison of the economic benefit of two or more project options must consider what else we might have done with our money (i.e., in the case of existing capital) had we chosen to invest in something other than the available project options or what it would cost us to borrow the capital if necessary (i.e., loan rate). In constant dollar LCCA methodology, opportunity cost is accounted for through the use of the "real" discount rate (d).

The discount rate is a special type of interest rate that makes the investor indifferent between cash amounts received at different points in time. That is, the investor would just as soon have one amount received earlier as the other amount received later. For example, with a discount rate of 5%, the present value of a cash amount of $100 receivable at the end of 5 years is $78.35. To the investor with a 5%discount rate, these two amounts are time equivalent, meaning the investor would have no preference between $78.35 received today and $100 received at the end of 5 years. However, the investor would prefer investing $78 to receive $100 at the end of 5 years.

Equation 3 may be used to discount a future cost to its present value equivalent, such as the natural gas price previously determined using Equation 2. Although the future price of natural gas at the end of year-10 may be $1.62 per therm, to an investor with a real 3% discount rate, that therm of natural gas is only worth $1.21 today (net present value). With a 3% discount rate, the investor is only willing to spend up to$1.21 today in order to save a therm of natural gas 10 years from now.

Figure 2 illustrates how a uniform $1,000/year future cost is discounted to present value terms using "real"3%, 5%, and 7% discount rates. Note that as the discount rate increases, future savings is worth less interms of net present value and fewer project alternatives are viable.

The discount rate is one of the most important LCCA assumptions. Because the value is specific to each owner, it is important to spend time discussing the time-value-of-money and cost of capital with the owner early on in the design process. If the client does not have a specific discount rate in mind, a 3% discount rate is a commonly used value and a good starting point. Discourage the use of discount rates that are above 7% or below 2%. If the client already has a discount rate in mind, make sure that it is a "real" rate when performing a constant dollar analysis.

Equation 4 may be used to convert a "nominal" discount rate into a "real" discount rate, given the assumed level of general price inflation (i).

Estimating capital, operational costs

Capital costs (I + Repl – Res): Capital costs include the initial cost of construction in addition to any replacement costs, disposal costs, and residual value remaining at the end of the study period. Once these capital cost components are discounted to their net present value equivalent, they may be aggregated to determine the total capital cost for a particular alternative.

Initial investment (I): Absolute costs for each design alternative are typically not required for most LCCA studies. LCCA is intended to evaluate whether incremental savings justify an incremental investment. Investment costs therefore need to be developed only for the components that vary between alternatives.For example, in comparing two HVAC systems that have the same zonal equipment (e.g., variable air volume, or VAV boxes) but varying central equipment (e.g., air handlers), the zonal equipment costs can be ignored and only the costs of the central equipment developed. It is important to be as complete and thorough as possible when considering project cost variations between alternatives; all costs that vary must be captured to make valid comparisons.

Detailed construction cost estimates are not necessary for preliminary economic analysis. Such estimates are usually not available until the design is quite advanced and the opportunity for cost-reducing design changes has been missed. Quotes for purchase and installation costs can often be obtained from local suppliers or contractors. You can also develop estimates by adding unit costs obtained from construction cost-estimating guides. Since estimates are based on different underlying assumptions and have different emphases, it is recommended that the analyst use the same data set for each alternative being considered to get consistent and comparable results. As with all LCCA assumptions, refine initial investment cost estimates as more reliable data becomes available.

Unless there is a long planning and construction period or a great deal of time between equipment pre-purchase and building occupancy, initial investment costs are typically incurred as of the base date and considered to already be in present value terms (i.e., may be used directly in Equation 1 (I)).

Replacement costs (Repl): The number and timing of capital replacements depends on the estimated life of the system and the length of the service period. For example, if the time frame of a study is 30 years and a component of a mechanical system (e.g., a heat pump) needs to be replaced every 10 years,then the lifecycle costs need to include the cost of that replacement at year 10, year 20, and year 30.

Initial construction cost estimates are generally the best source for estimating replacement costs.However, be sure to account for any additional demolition or rigging requirements that may not have been included in the initial construction cost estimates. Remember, constant dollar LCC methodology assumes that prices for all goods and services, other than for energy and water, will increase at approximately the same rate as general inflation. Future replacement prices do not need to be escalated unless there is a documentable basis for assuming that the prices will change at a rate different than general inflation.Regardless, replacement costs must be discounted to their present value for use in Equation 1 (Repl).

Factoring system and component replacement costs into LCCA calculations requires making a number of assumptions about the useful life of these items. Chapter 37 of the 2011 ASHRAE Handbook–HVAC Applications includes median service life estimates for a variety of mechanical equipment, which may be used as the basis for determining the timing and frequency of capital replacements. These assumptions should be clearly stated and documented so that they can be understood and confirmed by the owner.Sensitivity tests can demonstrate how lifecycle costs vary in response to changes in equipment life assumptions and can provide clients with additional information for risk assessment and decision analysis.

Residual value (Res): For systems with expected lives extending beyond the end of the study period, the residual value should be based on their value in place, not on their salvage value as if they were to be removed from the building at that point. As a general rule of thumb, the residual value of a system with remaining useful life in place can be calculated by linearly prorating its initial cost. For example, a system with a 15-year life expectancy installed 5 years before the end of the study period would retain 2/3 of its initial cost. The residual value must be discounted to present value for use in Equation 1 (Res).

When the study period is very long, the residual value of the original system may be small and largely offset by disposal costs. Discounting further diminishes its weight in the analysis, and so it is often less important to improve the estimate of a residual value than of other input values. But when the study period is short or life expectancy for a given system is particularly long (e.g., geothermal systems), the estimate of the residual value may become a critical factor in assessing the cost-effectiveness of a capital investment project and it should be given careful consideration. As with replacement cost assumptions,residual value based sensitivity testing can provide decision makers with additional, valuable context.

Operational costs (E + OM&R): The operational cost category includes energy costs (E) and recurring operations, maintenance and repair costs (OM&R). Once these operational cost components are adjusted to their net present value equivalent, they may be aggregated to determine the total operational cost for a particular alternative.

Energy costs (E): Although energy performance for many secondary components (e.g., pumps, heat exchangers, etc.) can be determined using demand profiles, simplified degree-day, or bin calculations, LCCA should be coupled with hourly whole building simulation. If alternatives provide different indoor environmental quality (IEQ) benefits, it is important to express those differences in terms of energy expenditures. For example, when comparing displacement ventilation systems to traditional overhead distribution, improved ventilation efficiency should be quantified by adjusting outdoor air intake in the energy model until both alternatives provide the same amount of ventilation air in the breathing zone.Similarly, in radiant heating applications, improved thermal comfort should be quantified by adjusting space set points until both alternatives provide equivalent percentage people dissatisfied (PPD) or predicted mean vote (PMV).

Energy costs should be calculated for each design alternative using actual utility rate structures for the project’s base year, particularly when evaluating demand reduction or peak load shifting strategies. If rate structures are unavailable or unknown, the U.S. Energy Information Association (EIA) publishes average blended rates for the residential, commercial and industrial sectors, broken down by region of the country for a variety of fuel types. While these blended rates can be a good starting point, take care when applying them to metropolitan areas; utility prices in major cities tend to be significantly higher than regional averages.

With base-year energy costs calculated and energy cost escalation rates determined, future energy costs for each year in the study period may be calculated. Once future energy costs have been discounted to their net present value as of the base date they may be summed for use in Equation 1 (E).

Operations, maintenance, and repair costs (OM&R): OM&R costs are often more difficult to estimate than other building expenditures. Because operating schedules and maintenance standards vary from building to building, there is great variation in associated costs even for buildings of the same type and age. It is therefore especially important to use engineering judgment when estimating these costs.

Cost estimating guides may be used to calculate initial assumptions, but the most direct and reliable method for estimating OM&R costs is to obtain preventive maintenance service contract quotes directly from equipment manufacturers. Remember, as with initial investment costs, only the incremental OM&R costs need to be considered. If OM&R costs are essentially the same between project alternatives, they do not have to be included in the LCCA.

Tools for calculating LCC

There are several software programs that simplify LCC calculation and results documentation. One of the most widely used is BLCC5, which was developed by the National Institute of Standards and Technology in support of the Federal Energy Management Program (FEMP). It computes the LCC for project alternatives, compares project alternatives to determine which has the lowest LCC, performs annual cash flow analysis, and computes supplementary measures of economic performance including net savings,savings-to-investment ratio, and adjusted internal rate of return for project alternatives over their designated study period.

While BLCC5 is useful for most LCCA studies, more advanced analysis techniques are not supported. LCCAid is a Microsoft Excel-based tool developed by the Rocky Mountain Institute that provides additional flexibility, including multi-parameter sensitivity testing.

David J. MacKay is an associate with Kohler Ronan LLC in the New York City office. MacKay’s expertise includes building performance modeling, building commissioning, energy auditing, energy reduction plan development and energy procurement consulting.