While financial MEP revenue went up slightly, the number of engineers employed dropped dramatically.

MEP Giants insights

- The 2025 MEP Giants generated $15.02 billion in MEP and fire protection engineering design revenue — up 2.6% from last year — while overall gross revenue declined slightly, illustrating continued strength in core services despite broader economic pressures.

- The MEP Giants also experienced a sharp 25.65% drop in MEP/FP engineering staff, highlighting major shifts in workforce dynamics even as these firms maintain a strong presence in various project types and international markets.

The 2025 MEP Giants generated $15.02 billion in mechanical, electrical, plumbing (MEP) and fire protection engineering design revenue, a slight increase (2.6%) over last year’s MEP Giants’ revenue of $14.64 billion. This year, the 2025 MEP Giants earned approximately $73.79 billion in gross annual revenue during the previous fiscal year, a 2.26% drop from $75.5 billion.

Once again absent from the top 10 was AECOM, which has been on this list previously. There were also some newcomers to the total of 100 companies. A dozen companies either joined the list for the first time or returned after time away from reporting data (in alphabetical order): Bala Consulting Engineers; Bard, Rao + Athanas Consulting Engineers; Cleary Zimmermann Engineers; EMA Engineering & Consulting; Finnegan Erickson Associates dba FEA Consulting Engineers; Kohler Ronan; Michael Baker International; PAE Consulting Engineers; Rist-Frost-Shumway Engineering; WD Partners; Wendel; and Wiley|Wilson.

The list this year comprises 59% private companies (flat in comparison to 2024), 28% employee-owned companies, 8% limited-liability companies and 5% public companies. The 2025 MEP Giants are made up of consulting engineering firms (63%, up from 60% last year) and architectural engineering firms (30%, down slightly from 31% last year).

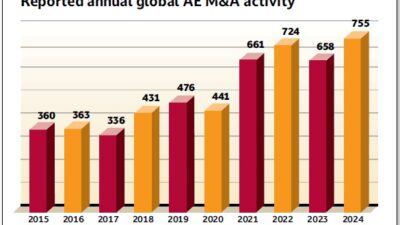

Several mergers and acquisitions occurred in the past year; 21% of the firms reporting acquired another company, a slight dip from last year’s 25% acquisition rate (see the article “Deals by MEP Giants neared record high last year”).

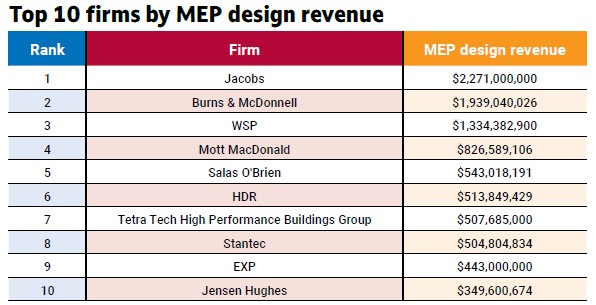

Table 1 shows the top firms based on MEP design revenue, which is how the MEP Giants are ranked.

MEP Giants Survey methodology

At the beginning of 2025, the Consulting-Specifying Engineer staff collected and analyzed data from several consulting and engineering firms. Some of the top mechanical, electrical, plumbing and fire protection engineering firms submitted their firms’ profiles to Consulting-Specifying Engineer; however, not all consulting firms were willing or able to participate in this year’s MEP Giants survey. The smallest amount of MEP design revenue reported this year was more than $16 million, about the same as in the last reporting period. Some firms were unable to report final data.

In 2025, more than 100 engineering firms provided their information for the MEP Giants program, with some newcomers or firms reentering the program. Data and percentages are based on the top 100 companies that responded to the request for information; the results do not fully represent the construction and engineering market as a whole. However, with nearly identical questions asked in previous years and more than 100 engineering firms participating this year, we present a qualified portrait of where the top engineering firms stand in 2025.