The 2025 MEP Giants continued their robust pace of acquisitions in pursuit of strategic expansion.

Merger and acquisition (M&A) insights

- While the number of 2025 MEP Giants making deals dipped last year, big buyers ramped up activity and drove total acquisitions to a near-record level.

- Sun Belt firms continue to be the most attractive M&A targets for MEP Giants.

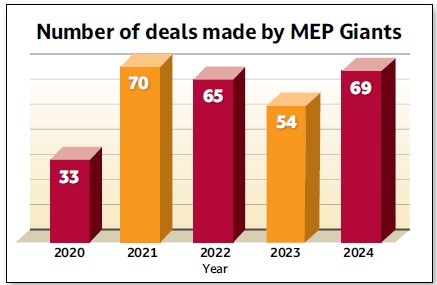

Rather than tapping the brakes in the face of global geopolitical turmoil and economic uncertainty, Consulting-Specifying Engineer’s 2025 MEP Giants hit the gas last year and accelerated their already vigorous pace of deal-making. As a group, the largest mechanical, electrical, plumbing (MEP) and fire protection engineering firms completed 69 acquisitions in 2024 — a 28% jump from the previous year and just one deal short of the 2021 all-time high.

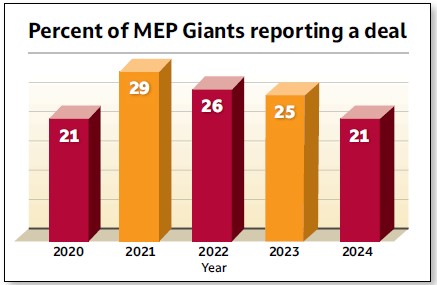

While the percentage of MEP Giants making at least one acquisition fell from 25% in 2023 to 21% in 2024, more of the industry’s biggest players made multiple deals. Twelve MEP Giants finalized more than one acquisition in 2024, compared to nine the year before, propelling total deal volume to a near-record level.

MEP firms of all types are prime targets in the merger and acquisition (M&A) market. According to Morrissey Goodale’s propriety database of architecture, engineering (AE) and environmental industry deals, MEP firms are commanding median valuations around seven times annual EBITDA (earnings before interest, taxes, depreciation and amortization) compared to median valuations in the range of six times annual EBITDA for engineering firms overall. With MEP firms in high demand over the past year, it’s no surprise that the MEP Giants aggressively pursued acquisitions to add specialties to their service lines while sellers looked to capitalize on favorable valuations.

M&A spike among MEP Giants reflects industry trend

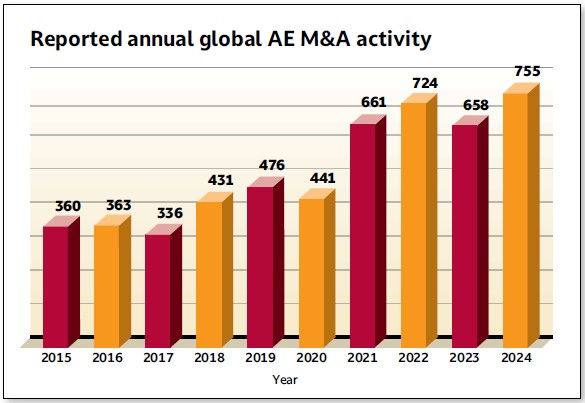

The deal-making surge among the MEP Giants mirrors the broader M&A boom among AE and environmental firms that’s been driven on the supply side by a wave of baby boomers and Gen-X sellers seeking capital to support growth and facilitate ownership transitions and on the demand side by strategic buyers and investors hungry for growth, talent and superior returns on investment.

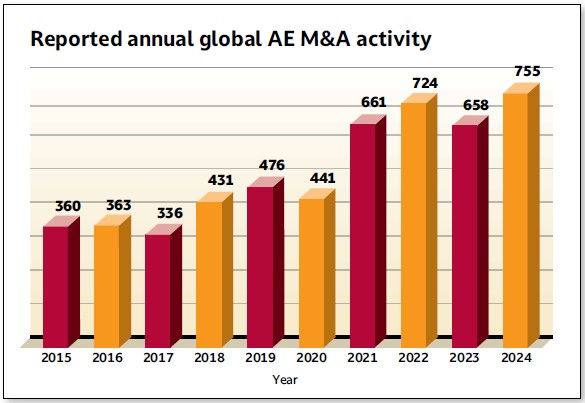

Morrissey Goodale tracked 755 global industry deals in 2024 — a new record that eclipsed the previous high of 724 worldwide acquisitions in 2022 and represented a 15% spike over the prior year. In the U.S., 476 transactions were concluded in 2024, just shy of the all-time domestic peak of 484 deals in 2022.

As with the wider AE and environmental industry, Sun Belt firms continue to be the most attractive M&A targets for MEP Giants. With eight and seven deals, respectively, California and Texas were the top states where MEP Giants completed acquisitions in 2024. That was followed by New York with five transactions and Colorado, Florida and Washington with four each. MEP Giants also concluded six international deals, with the purchases of two firms in Canada and one each in Finland, Spain, the United Kingdom and the United Arab Emirates.

Private equity deals up, but for how long?

The MEP Giants differ from the broader AE and environmental industry in the mix of buyer types pursuing acquisitions. While employee-owned buyers closed half (50%) of U.S. domestic AE and environmental industry transactions in 2024, they represented 42% of deals completed by the MEP Giants last year. The reverse was true for publicly traded buyers, which accounted for just 9% of overall industry deals but 29% of transactions made by the MEP Giants in 2024.

Private equity-backed buyers also accounted for 29% of deals consummated by the MEP Giants in 2024. That was up from 20% in 2023 but well below the 41% of acquisitions attributed to them across the entire industry last year.

The outlook for private equity involvement the AE and environmental industry bears watching. In 2024, the two most acquisitive MEP Giants were an employee-owned firm and a publicly traded company. However, broader industry trends suggest that private equity-backed buyers are here to stay, as they continue to represent a growing share of transactions each year. It will be worth watching whether private equity firms continue to establish new MEP platforms and pursue add-on acquisitions at a pace that brings their deal activity in line with the rest of the industry.

IMEG most active buyer among MEP Giants

Acquisitions have long been a key growth strategy for employee-owned IMEG (Rock Island, Illinois), the 2023 recipient of Morrissey Goodale’s Most Prolific and Proficient Acquirer Award. Last year the national engineering and design firm led all MEP Giants in deal activity, completing a dozen acquisitions that added nearly 600 employees in 11 states across the country.

Additional MEP Giants that continued recent buying sprees included NV5 (Hollywood, Florida), which consummated 10 transactions. Other MEP Giants that made multiple deals in 2024 were 2023 recipient of Morrissey Goodale’s Best M&A Post-Transaction Performance Award Salas O’Brien (Irvine, California), WSP (Montreal), RTM Engineering Consultants (Schaumburg, Illinois), Gannett Fleming TranSystems (Camp Hill, Pennsylvania), LaBella Associates (Rochester, New York), Michael Baker International (Pittsburgh), Stantec (Edmonton, Canada), Legence (San Jose, California), Tetra Tech (Pasadena, California) and DLR Group (Omaha, Nebraska).

Despite increased economic volatility in 2025, MEP firms are looking at another banner year of revenue growth and profitability. With many CEOs reporting that 2025 is on track to be at least as strong as 2024, firms are capitalizing on the opportunities at hand by continuing to invest heavily in acquisitions as a critical component of strategic expansion.

M&A activity in the AE and environmental industry showed no signs of slowing down in the first half of 2025, and Morrissey Goodale expects this momentum to carry through the rest of the year. Buyers remain focused on securing expertise in public infrastructure and mission critical markets, while sellers are motivated by attractive valuations and opportunities to join larger platforms with deeper and better corporate resources. These dynamics continue to fuel deal-making, particularly in high-growth markets such as Texas, Florida and the Western U.S. If trends continue, it would be no surprise to see M&A activity set records once again in 2025.