The Deals Database provides real-time reporting of M&A multiples to show how the industry has been changing over the past decade.

Morrissey Goodale’s proprietary Deals Database provides real-time reporting of industry M&A multiples. It’s updated continuously and currently contains detailed pricing information on over 270 A/E and environmental firm acquisitions from 2011 through last week. The data can be sliced and diced by deal size (revenues, employees, backlog, EBITDA, etc.), deal type (A, A/E, E/A, environmental, etc.), region (state, city), buyer type (publicly traded, ESOP, employee-owned, private equity), and cohort (lower quartile, median, and upper quartile).

While the Deals Database is typically used as an analysis and decision-making tool, it also tells the story of how the industry has been changing over the past decade. And what’s most stunning is how it reveals the relentless increase in the value of the industry’s most highly sought-after firms.

The gold standard indicator: The Rosetta Stone of the M&A world is EBITDA (earnings before interest, taxes, depreciation, and amortization). It’s the primary translator of an acquired firm’s performance to its valuation. Deal prices are frequently quoted as a multiple of the acquired firm’s EBITDA in the year before it was sold (commonly referred to as the “trailing twelve months”).

An inexorable increase in valuations: What the Deals Database reveals is a steady increase in the upper quartile EBITDA M&A multiples over the past decade from 6.93 in 2011 to 8.2 where it currently stands—an 18% increase. This is distinct from the median EBITDA multiple which has remained relatively flat over the same period, and the lower quartile multiple which has actually declined over the past ten years (ouch!).

The bifurcated market for firms is real: The past decade has seen a clear separation in the industry. The most sought-after acquisitions command ever-increasing premium pricing and higher multiples (and typically also more favorable terms), at the expense of the valuations for less attractive firms. There is an abundance of capital pursuing industry acquisitions, it’s not unlimited. And if it favors higher performers, it therefore reduces demand for median or lower performers. In other words, there are winners and there are losers.

The Magnificent Seven: A variety of factors or characteristics contribute to a firm achieving an upper quartile multiple at the time of sale. The more factors and characteristics in play, the higher the multiple that can be achieved. None of these factors or characteristics by themselves guarantee an upper quartile multiple, but they are good leading indicators. Those Magnificent Seven factors are:

1. Size

2. End markets

3. Technical expertise

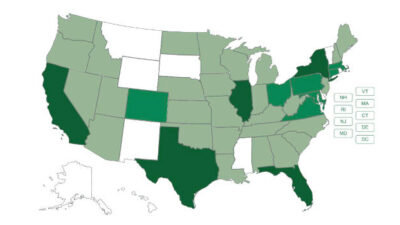

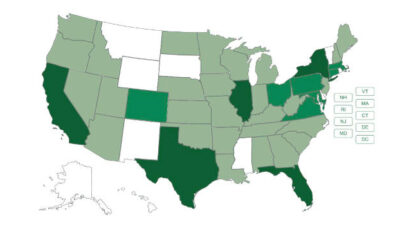

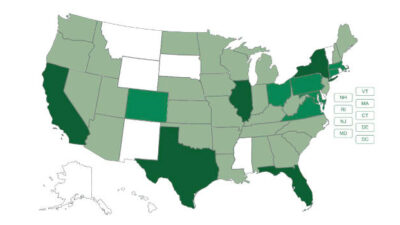

4. Geography

5. Financial performance

6. Backlog

7. Quality of leadership/management.

All things being equal: Each of the Magnificent Seven deserve an individual analysis that we don’t have time for here. But in general, larger firms with deep-dive technical expertise in “hot” end markets and geographies, with a track record of consistently strong financial performance, robust backlog, and a forward-looking leadership and management team have the highest probability of achieving upper quartile valuation multiples. Look at the strategic plans of some of the industry’s top performers and you will see that it’s no accident that they have goals and objectives articulated around each of these factors. Does your strategic plan look to create such value for owners?

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.