Rumors can kill an A/E firm sale. It’s the CEO’s job to manage them.

“Rumours.” A classic 1977 album by Fleetwood Mac? Yes! A huge problem for leadership teams exploring a sale of their firm? For sure. Rumors can kill a firm sale. It’s the CEO’s job to manage them.

1. The first rule of “Sellers Club” is: There is no firm sale. If you are exploring the sale of your firm, the best practice is to keep the exploration process confidential within a “circle of trust” (most often the board, founders, or C-suite depending on the situation) until practical to do so (typically after you sign an LOI and enter due diligence). Why keep things confidential? You don’t want your clients to know you are considering a sale as it may impact contract (re)negotiations or project bids. You don’t want to alarm your employees because they’ll worry unnecessarily about how a change in control will impact them individually and create a self-perpetuating internal gossip machine that needlessly distracts everyone from doing their jobs. And you definitely don’t want anything leaking to your competitors as they may use the information to interfere with your employees or clients. (Note: The last concern is almost always overblown, but it’s a legitimate worry for sellers.) Importantly, you also want to keep the exploration of a sale confidential because you may not end up actually selling the firm since the right buyer or investor may not materialize.

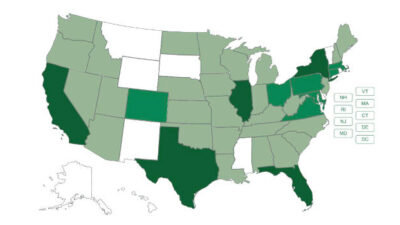

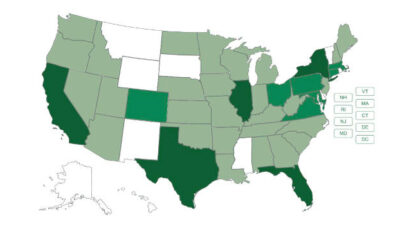

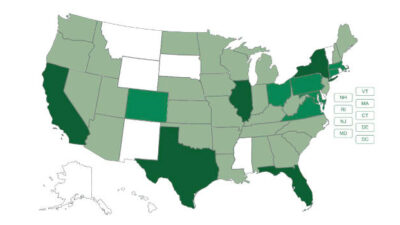

2. Those who know don’t talk: However, with record industry M&A activity (there will be over 450 acquisitions this year), the rumor mill is in full swing. The gossip mongers among your peers, competitors, and employees are having a field day. It seems like everyone (warning: REO Speedwagon reference ahead) has a friend who heard it from a friend who heard it from a friend whose cousin is the CFO at ABC Associates who has it on very good authority that the firm is selling to “venture capital.” Or that ABC is “spinning off” its water business to “one of the big publicly traded firms and everyone is leaving!” (Every rumor tends to come with some drama or salacious innuendo.) It’s the classic old game of telephone (readers under 40 should Google this). The rumor distorts and magnifies as it gets passed around until it bears little resemblance to the original conversation, which itself may not have been grounded in fact. In this super-heated M&A environment anyone who is not in the 450 industry “circles of trust” is likely aware of these rumors and suspects that their own firm may be for sale. And that particular dynamic has led to an increasing number of awkward conversations for CEOs who are actually leading the exploration of a sale.

3. Preparing for the “I hear we’re for sale” conversation: All the internal controls (including Non-Disclosure Agreements) put in place by leadership teams around the exploration of a sale of their firm cannot protect against the giant rumor mill that’s at play in the industry at large today. So, it’s not uncommon for CEOs who are leading the effort to explore a sale to get an unexpected visit in their office or to receive an unscheduled Teams call from a concerned employee (or even a group of employees) asking if the rumors that they have heard about the firm being sold are true. This puts the CEO in a really tough position. He must keep the sale process confidential to the agreed-upon “circle of trust.” However, he must also do his best to allay concerns and stop the rumor mill. It’s a crucial conversation, a hard one to navigate, and one for which most CEOs receive no coaching. If you are in this position, here are three pieces of advice I like to give CEOs and their respective “trust circles” to help them prepare for and navigate these discussions.

4. First, don’t be defensive: Acknowledge the specific rumors, make it clear that you are aware of them circulating, and importantly put them into context. I like to coach CEOs to respond with something like this (said with a smile): “I’ve heard those rumors too! Indeed, the board recently discussed a rumor floating around that we are selling our mission-critical business (or insert other actual rumor here). Seems like every meeting I go to these days folks are talking about this or that firm that’s for sale. Listen, I try to stay away from rumors, and you should too.”

5. Second, address the business case: Make it clear that a firm sale is not beyond the realm of possibility, however you and the firm’s leaders would only choose to sell the firm if it were in the best interests of all stakeholders. My suggested coaching here is along the lines of: “In this market, we get approached all the time about selling the firm. It’s no surprise because we are so successful and have a great reputation. If we were ever to actually sell the firm, it would only be if the board felt it presented a way for us to better serve our clients and provide more opportunities for all of our employees.” What you are doing here—correctly—is distinguishing between exploring the sale of the firm (which you are duty bound to keep confidential) and the act of “selling” the firm—which technically only occurs when the purchase and sale agreement is signed. It’s a fine line, but if you stick to it, you can achieve all the goals you need to in the discussion.

6. Third, bring it home with confidence: Here, you are reaffirming your relationship with employees and also signaling to them what may happen (in reality what will happen if you are successful). It makes clear their importance as stakeholders and again reinforces you are on point. My suggested coaching is to say something like: “Believe me—if we were ever to be in a position where we made the decision to actually sell the firm, you and the rest of the employees would know the details first, and you would know long before any rumor-spreader from the outside would become aware.”

7. The upshot: Selling your firm is one of the most important things you will do. It’s also a fraught process. The rumor mill that goes along with today’s super-heated M&A environment is creating additional challenges for sellers to successfully manage the exploration of a firm sale. CEOs should be prepared to address rumors of a firm sale in a way that maintains the confidentiality while at the same time addressing employee concerns.

– This originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media and Technology content partner.