Morrissey Goodale is providing A/E leaders with news and perspective on COVID-19 and its impact on the industry. This week, they examine how mergers and acquisitions are expected to explode in 2022.

Morrissey Goodale is providing A/E leaders with news and perspective on COVID-19 and its impact on the industry. This week, they examine on how CEOs are being forced to adjust to new realities with their workforce when it comes to expectations.

The national and trade news cycles are wall-to-wall coverage of the administration’s “Infrastructure Bill.” Regardless of whether it passes in its existing form or in some scaled-back manner this year, it will likely usher in a surge for the A/E industry. What’s less apparent is that it will drive a spike in M&A activity in the fourth quarter this year that will carry over well into 2022 and beyond. Why? Supercharged supply and demand, that’s why.

First, let’s talk demand: A/E, environmental, PM/CM and geospatial/mapping firms are proving to be very attractive investments for private capital. There’s a reason why private equity (PE) funds and family offices have been driving the industry’s recapitalization. Their “investment thesis” (you hear that phrase a LOT in the PE world) is that (a) U.S. infrastructure will need both major improvements and on-going maintenance and (b) there will always be a need for more public and private funding for both. They see the A/E and environmental industry as one of a number of ways for them to generate healthy returns in the infrastructure sector.

Federal dollars spices demand: The increased probability of Federal infrastructure stimulus spending only makes our industry more attractive to private capital. With Federal stimulus dollars now more likely, many PE funds and family offices that were in our industry are aggressively ramping up efforts to grow their position – either by expanding their existing investments through M&A or spinning up new platforms. Those that have been considering an investment in the industry for a while or have been on the fence are ready to pull the trigger and jump in now to make sure they are invested before a new wave of Federal funding hits. Groups that previously had zero interest in the A/E industry (and don’t know a designer from a contractor) are pouring hundreds and thousands of dollars into researching what we do and looking for an entry point – i.e., a firm (or firms) to invest in.

Everyone wants in on the action: What’s interesting is that these new investors run the gamut of the private capital world. We’re seeing serious interest from funds with as little as $100 million to invest. These are often times one or two ex-Morgan Stanley principals who are investing on behalf of their high net worth clients. At the other end of the spectrum, we are seeing the multi-billion-dollar Family Offices of some of the most iconic brand names in the U.S entering the industry.

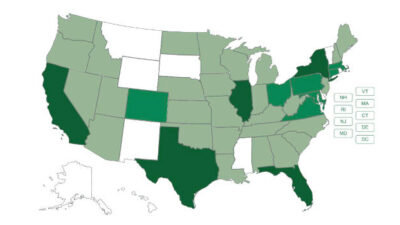

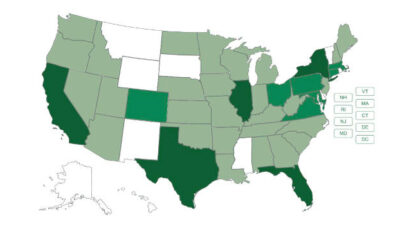

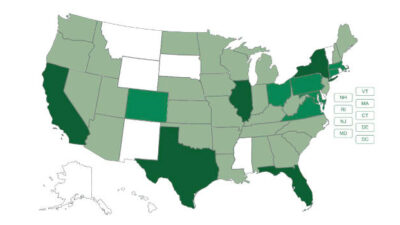

Don’t forget about the strategics: Beyond private capital investors, the largest publicly traded, ESOP and employee owned “strategic” acquirers are ramping up their acquisition outreach – particularly in the transportation, water, utility, and clean energy sectors to a whole new level. Basically, we’ve reached a point in the industry that if you’re an A/E firm or environmental owner and you are not getting contacted daily by suitors to acquire your firm you need to ask why not, even if you’re not in the market to sell.

Render unto Caesar stimulates supply: While all the talk of Federal Infrastructure stimulus is ramping up demand for A/E and environmental firms, the discussion related to increased taxes for corporations and high income folks to pay for all the spending is juicing up supply. If a bill passes, owners of A/E firms will likely see their taxes increase in 2022. So, while an Infrastructure Bill will benefit their business overall, it will likely hit them in their pocketbooks by taking a larger bite in taxes out of their income. In the words of the Hoodoo Gurus it’s all so bittersweet.

A rush to the exits: A/E firm owners are smart. And for those of a certain age with a certain set of circumstances (i.e., no internal transition options), they right now are figuring it might be better for them to sell their firms in 2021 and lock in this year’s lower tax rates on the proceeds rather than expose themselves to a – as of yet still unknown – anticipated higher tax environment in 2022 and beyond.

History repeating itself: We saw this exact same phenomenon in 2012. The Obama administration signaled that they were planning to let the Bush era tax cuts expire in 2013, effectively raising taxes. At the time, the A/E industry was still struggling after the Great Recession. A/E firm owners did the math and figured how much they could save if they sold their firm in 2012 ahead of tax increases – even if they had to do so at a discounted price.

Fourth quarter spike in M&A: Saving money in the form of avoiding higher taxes is a powerful motivator. That’s why in the second half of 2012, A/E firm owners flooded the market in an effort to sell their firms before the clock struck midnight on December 31. What resulted was a remarkable spike in fourth quarter M&A activity. The fourth quarter of 2012 was the most active period on record for deals up until that point with 59 transactions announced. The tax effect transformed what had been until then a pretty moribund year in terms of M&A activity into a whopper. We’re expecting to see a repeat of this effect this year.

The stars align: The combination of (a) the promise of Federal stimulus spending with (b) the potential for tax increases next year creates a situation that sets the industry up for an extraordinary wave of M&A in the second half of the year and particularly in the fourth quarter. The buyers are in the market and eager, the capital is ready to be allocated, the sellers are motivated and incentivized to move quickly. (Pro-tip to sellers: Choose your buyer wisely, many will claim they can get your deal closed by the end of the year – most will be unable to. Don’t waste time with tire-kickers or pretenders.)

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.