As transactions increase industrywide, more mechanical, electrical, plumbing and fire protection engineering firms jump in

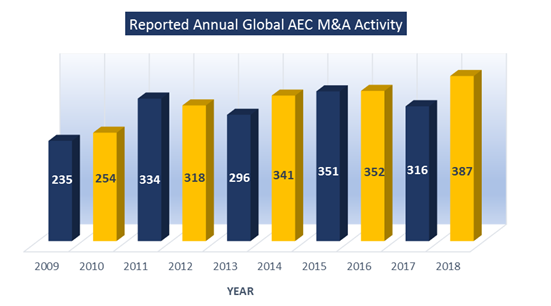

A record-setting 387 deals were consummated globally in the architecture, engineering and construction industry in 2018, up 23% from the prior year and surpassing the previous high-water mark of 352 deals struck in 2016.

The increase in corporate marriages came largely from growth in U.S.-based deals, which rose 33% year over year while the international deal count remained approximately flat. This is likely due to stronger economic fundamentals in the U.S. relative to the rest of the world and greater expectations for future growth in this country. Also, the tax reform package passed by Congress in the waning days of 2017 freed up corporate cash for growth initiatives in 2018, including mergers and acquisitions.

Mirroring overall growth in industry mergers and acquisitions activity, Consulting-Specifying Engineer’s 2019 MEP Giants stepped up their own deal-making in 2018. The number of deals made by the largest mechanical, electrical, plumbing and fire protection engineering firms rose substantially in 2018 as the group recorded 49 transactions, up 32% from the 37 deals made by the group in 2017.

Several firms made multiple acquisitions over the course of the year, with Stantec leading the way among MEP Giants in 2018 with a whopping nine deals recorded. Other notable acquirers included Salas O’Brien (5 deals), NV5 (4 deals) and WSP (4 deals).

Of further interest is that sheer numbers alone don’t tell the whole story of 2018 acquisitions — in the past year, a greater percentage of MEP Giants got in on the action. In fact, 25% of the MEP Giants reported a transaction in 2018, up notably from 2017, during which a still-respectable 16% of the industry-leading group notched a deal.

Drivers of deal–making

Given the macro-level trends at work in the industry, Morrissey Goodale expects the rapid pace of deal-making to continue. Below are the most significant factors driving AEC industry consolidation.

- Strong U.S. economy and industry. A decade into its current expansion, the U.S. economy remains on solid footing. Job growth continues to be strong, incomes are rising and reports from the Federal Reserve’s Beige Book indicate optimistic expectations for ongoing growth around the nation. The outlook for the engineering industry is also robust in the U.S., as revenues are growing and expectations for the future are positive. As reported in the U.S. Census Bureau Quarterly Services Survey, revenue for engineering firms in 2018 grew 12% year over year. Investor sentiment also indicates positive expectations for future growth in the industry, as Zacks Investment Research’s engineering industry index reports a 23% year-to-date increase in the stock prices of publicly traded industry firms as of this writing.

- Industry life cycle. Engineering is a mature industry, which means the dynamics of supply and demand are well-established and the sector is past the early-stage, high-growth phase seen in younger sectors such as technology. While sustained, gradual growth is certainly expected, firms in mature industries often grow quicker than their peers by claiming a larger slice of the overall pie. This dynamic applies to the engineering industry and is part of the reason we see elevated levels of consolidation as firms try to gain market share or improve earnings via economies of scale. The record level of deal-making activity in 2018 proves mergers and acquisitions have become an accepted driver of business growth in the industry. And there is plenty more opportunity for consolidation, as there are approximately 82,000 professional design firms in the U.S. alone, according to the latest available data from the U.S. Department of Commerce.

- Influx of private capital. Private equity firms have continued to make their presence felt in the industry, continuing a multiyear trend of increased deal-making. Last year, PE accelerated deal-making in the domestic U.S. as Morrissey Goodale tracked 49 U.S. PE-backed deals, up from 37 U.S. PE-backed deals in 2017. PE firms have made investments in some of the top firms in the industry — notable transactions in 2018 included First Reserve recapitalizing CHA Consulting (Engineering News-Record No. 54), Wind Point Partners acquiring Kleinfelder (ENR No. 60) and Sentinel Capital Partners recapitalizing Apex Companies (ENR No. 71-ranked environmental firm). With more and more PE firms seeing the industry as a consolidation opportunity, we expect ongoing recapitalizations of engineering and architecture firms and more investments in strategic players in 2019. The relatively low cost of borrowing has continued to be a boon to PE-backed deals in the industry, as leveraged financing is a staple of the PE business model. With low long-term interest rates, muted inflationary expectations and relatively accommodative monetary policy, we expect low cost of capital to continue to help bolster industry PE deals.

- Ownership transition challenges. Right now, we are in the midst of a generational turnover that is supporting mergers and acquisitions activity in the industry. Specifically, the baby boomer generation, many of whom founded firms or retain significant ownership in their firms, are at or nearing retirement age and are looking to liquidate their stakes or reduce their risk as they move on to the next phase of their lives. Internal ownership transition, however, faces significant challenges as many millennials are either unwilling or unable to take ownership stakes in their firms. Financial constraints are of particular concern — according to a Wall Street Journal article published in May, young household wealth has fallen to its lowest level in decades. Rising levels of student debt, declining affordability of homes in a number of major cities around the nation and depleted savings from the Great Recession all represent competing demands on the financial resources of would-be engineering firm owners. As a result, many retiring shareholders lack an internal market for their shares and are looking to external sales as a means of transitioning ownership.

- Talent shortage. Difficulty finding workers is a primary concern in the industry — especially when it comes to hiring experienced, licensed professionals. The current dearth of talent we see is in part a result of the Great Recession, during which many professionals left the industry or were forced out due to lack of available jobs. However, the rapid growth of software and technology companies, particularly venture capital-backed startup companies, led technically inclined individuals — i.e., potential design engineers — to choose professions other than a traditional engineering track. And the trend has continued 10 years after the Great Recession officially ended — the number of computer science degrees is growing more than twice as fast as traditional engineering degrees, according to DataUSA. Compensation and company culture also have made the software and information sector more attractive. According to the Bureau of Labor Statistics, software developers and computer programmers earn approximately 10% more on average than their traditional engineering counterparts. Additionally, the company culture and workplace environments of software and technology companies cater to the values held by many millennials, while workplace environments of engineering firms tend to be more traditional. As a result of this talent shortage, many strategic buyers are motivated to use acquisitions as a means of building their workforce.

What’s Next

Morrissey Goodale’s data and research indicate the trends that made consolidation so appealing to industry executives in 2018 will continue in 2019 and beyond. As of this writing, 2019 appears to be on track for another record-breaking year for mergers and acquisitions activity, with 184 industry deals reported globally through the first five months of the year.

As firms of all sizes become more interested in how mergers and acquisitions may help achieve strategic goals, we predict more prospective buyers and sellers will enter the market and more MEP firms will join the ranks of deal-makers.