Engineering News-Record released its annual list of the industry’s Top 500 Design Firms

Last week, Engineering News-Record (ENR) released its annual list of the industry’s Top 500 Design Firms. Perennially, the list has charted the fortunes and changing nature of the design industry. Compiling the list and interpreting the information is a massive and important undertaking by the ENR researchers and journalists. The list’s importance in shaping and benchmarking the industry cannot be overstated. This year it also reveals how the industry is changing and the pace of that change. Let’s decode what’s happening in the industry by looking at some of the numbers from this year’s Top 500.

500: Over time, the list itself has become a touchstone for aspirational industry firms. (There’s many AE firm strategic plans that begin with “Our vision is to be an ENR Top 200 firm by 2027!”) It’s the Match.com for the many private equity and family offices that are looking to find the perfect design firm platform to invest in the AE industry. Visit their offices and on their desks right beside Fortune and Forbes you’ll find Engineering News-Record. It’s the Tripadvisor for strategic acquirers from around the globe. (“We need to acquire a leading infrastructure firm headquartered in North Carolina. Where can we find the names of those firms?”) The Top 500 list is both the starting point and a reflection of the changes in the industry.

15: This is the percentage of the ENR Top 100 firms that is capitalized by private equity. (It’s 13.5% for the Top 200.) The speed at which the private-equity model has been adopted by the industry’s largest design firms has been stunning—almost quadrupling from just 4% in 2016. Over the same period, the number of Top 100 design firms that directly or indirectly are publicly traded has remained pretty constant at between 19 and 20 each year. However, the employee-owned and/or ESOP capitalization model has steadily declined in popularity among the industry’s top designers. Just two-thirds of the ENR Top 100 are now employee- and/or ESOP-owned—down from three-quarters in 2016. Will this recapitalization of the industry’s leading design firms continue? The next number suggests that it will.

90: That’s the percentage of sales or recapitalizations of ENR Top 500 firms in calendar 2021 that involved private equity. (It’s also coincidentally the same percentage for the 12 months ending April 30, 2022.) What happens if this 90% number holds up going forward? Well, we’re projecting that on average between 25 and 30 of the ENR Top 500 firms will sell or recapitalize every year through the end of 2026. Assuming 90% of those firms choose private equity, then it’s likely one-third of the industry’s top designers will no longer be employee-owned within four-and-a-half years and will instead be capitalized by outside equity.

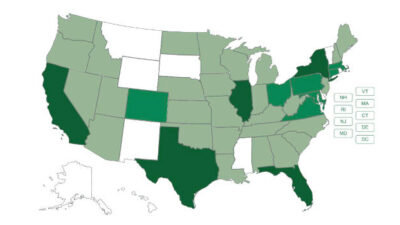

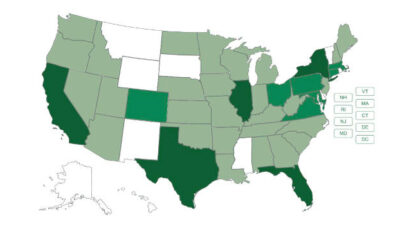

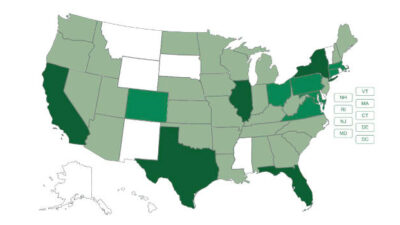

174: This is the position on the Top 500 list occupied by DCCM (Houston, TX). DCCM stands for Design, Consulting, Construction Management. The firm was not on the list last year. In fact, DCCM didn’t even exist as an operating firm two years ago. Rather, it was a plan, an intention, a thesis on the part of a private equity group. In 2020 and 2021, that group invested in and acquired five design firms in Texas, California, and Georgia (R.G. Miller Engineers, Miller Survey Group, Binkley & Barfield, Coastland, and Rochester) and along the way created DCCM. The time from “idea” to Top 200 design firm was less than two years. This rapid growth pattern is seen in the other private equity-backed firms on the Top 500 list. Collectively their average annual growth rate outstrips the rates of the publicly traded and employee/ESOP-owned designers.

Where is this all heading? Our research and work suggest that private equity will continue to recapitalize the design industry at a rapid clip over the next five years. As one private equity director said to us last week when asked what she sees ahead given stock market gyrations and rising interest rates: “Rising interest rates are having zero impact on the way we are doing, viewing, or valuing deals. We are cash buyers.”

Morrissey Goodale is a CFE Media and Technology content partner.