Employee-owned brands will occupy a very different position in the industry

As if the Great Resignation, Great Reassessment, and Big Quit weren’t enough, employee-owned AE leadership teams are also caught in the middle of the Big Squeeze. And it’s not one of those warm and fuzzy happy squeezes. (Speaking of “Greats,” Hulu’s The Great deserves a big huzzah.)

Oh no, the Big Squeeze is a whole trifecta of bad. It’s one of those hugs that’s way too tight, far too long, and with a stranger. It’s a direct result of four trends that are converging over the next five years to remake the AE industry. (See January 10’s Word on the Street.) And when the bear hug is over, employee-owned brands will occupy a very different position in the industry. And it starts with firm valuations…

1. You think real estate in Aspen is expensive? Try buying an AE or environmental consulting firm these days. M&A valuations (a fancy way to say “prices”) for design and environmental firms are at all-time highs. One CEO that I spoke with this week described experiencing something akin to vertigo when he realized what he would have to pay for a preferred acquisition target. Other terms we’ve heard to describe today’s prices from similarly spooked executives are the fun “champagne multiples” and somewhat more concerning “nosebleed levels.”

2. Five frothy years ahead: The combination of buy-side demand factors (mature industry, private capital influx, infrastructure bill, talent constraints) and sell-side drivers (boomer and Gen-X owners cashing out at record rates, inability to transfer leadership and ownership internally, changed competitive environment) are teeing up five years of unprecedented industry hyper-consolidation. We expect volume to escalate at a rate of 10% annually with some 3,250 AE and environmental firms being sold between now and the end of 2026. Concurrently, deal prices—already at record levels—will increase further. Firms in high demand will see multiples approaching those typically reserved for tech firms, not professional services ones. Truth be told, we’ve been in the early stages of this market dynamic since 2018 when there was a step function in industry deal activity (that was the first year that annual deal volume exceeded 300 transactions) and associated spike in multiples.

3. Core competencies count: Such a M&A environment favors skilled buyers with ample capital whose core competency is creating and delivering superior, sustainable returns for shareholders through buying and selling businesses. In the AE industry those types of buyers are the cohort of publicly traded firms and the relatively new breed of private equity backed players. This M&A environment does not favor the majority of industry employee-owned firms for three reasons. First, their core competencies lie in designing solutions for clients—not in acquiring firms. Second, they are, for the most part, conservative in accessing and deploying capital rather than maximizing returns. Third, and most important, many are in the midst of the dreaded Nifty Fifty syndrome.

4. The Nifty Fifty Syndrome: AE and environmental firms experience this when more than 50% of their equity is owned by managers over the age of 55. Tell-tale symptoms of the syndrome include: less appetite for risk, slower decision-making, a reluctance to make long-term investments, and itchiness. All these factors taken together place employee-owned firms at a clear disadvantage in the competition to acquire high-performing firms over the next five years.

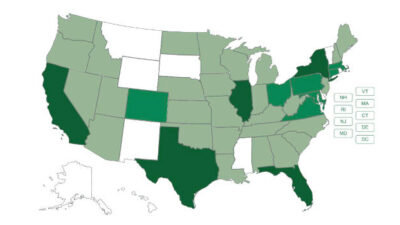

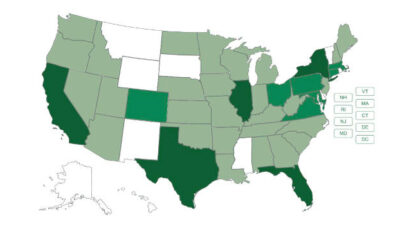

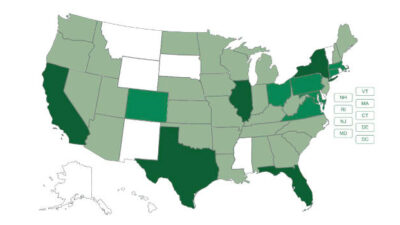

5. Consolidation, not acquisition: As we’ve moved into this high-multiple M&A environment, more and more employee-owned firms—which in the past were active and enthusiastic buyers—have been choosing to sit out the acquisition market. They do the math, figure the hit to their internal stock price, and pass because they figure it’s too darn risky. (Narrator: Can you say, “Nifty Fifty?”) Instead, they’ve been looking to consolidate and build on historic acquisitions that they have made in the past. As a result, the percentage of industry acquisitions completed by employee-owned firms has steadily declined from 71% in 2018 to 68% in 2019 to 66% in 2020 to an historic low of 56% in 2021. Indeed, when you look at the most prolific industry acquirers (See Word on the Street, October 11, 2021) there are zero non-ESOP employee-owned firms in the mix. We can expect the influence of employee-owned acquirers to continue to be diminished as prices increase through 2027. They will be squeezed out by private equity and publicly traded buyers.

6.The upshot: The Big Squeeze will put most employee-owned firms at a disadvantage in the upcoming period of industry hyper-consolidation. More often than not, they will find that the acquisitions that they need to make to achieve the goals in their strategic plans have been snapped up by their competitors with different capital models. The industry landscape at the end of 2026 will look decidedly less employee-owned. The employee-owned firms that will make it through the Big Squeeze are those high performers that can grow at 10% plus per year with profits north of 20% per year. The others will be watching from the sidelines as the industry gets remade.

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.