Morrissey Goodale is providing A/E leaders with news on the coronavirus and its impact on the industry. Highlights this week include a look at the A/E industry continuing to show strength, but with a note that the real challenges still lie ahead.

Morrissey Goodale is providing A/E leaders with news and perspective on COVID-19 and its impact on the industry.

COVID-19 UPDATE

National industry insights

- Even with unemployment at Depression-era levels, universities and schools closed, and the travel, hospitality, entertainment and retail sectors of the economy all but shut down since March, the A/E and environmental industry has continued to hum along relatively unscathed. This speaks to the industry’s resiliency— it moved to a remote working environment without missing a beat with many firms actually becoming MORE efficient. It also speaks to the essential nature of the industry itself.

- Of course, necessary layoffs and cost-cutting happened in March and April in A/E firms serving the hardest hit sectors of the economy. Those designers who lost jobs are quickly finding positions with other firms. (Our industry still has a shortage of quality talent.)

- And selective layoffs have also taken place over the past 3 months as firms have used this crisis to trim “B” and “C” players. (Note: Those folks are also being recycled into other firms— so beware— the “hire slowly, fire quickly” adage still applies, even in times of crisis.)

- But by and large the A/E and environmental industry has, for now, weathered this pandemic-induced national economic crisis. Even in those states with the most stringent stay-at-home regulations and in those hardest hit by the virus, design and environmental firms have continued to stay busy and sell work (see bullets 15 through 20 below for regional reports). Declines in revenue, where firms have seen them, have been offset by overhead reductions. In cases where projects have been put on hold, they have either restarted or been replaced by others. The stock prices of the industry’s publicly traded firms have held up well.

- Indeed, some firms are thriving in 2020. We know of firms that are paying bonuses based on Q1 performance. We know of firms that are returning their PPP loans because management determined they didn’t need them and believe giving the money back is “the right thing,” so funding can be accessed by firms that are in desperate need. Firms with Federal contracts continue to power ahead, by and large. Many firms are seeing a surge in work as states and local governments lay off staff.

- But a reckoning is on the horizon for the A/E industry at large. The capital budgets of state and local governments and agencies – which combined are one the largest purchasing blocs of A/E and environmental services, will be hit hard. The institutional, industrial and commercial sectors will also face challenges as they deal with their post-pandemic operating environments. While there will be opportunities as sectors recover and transform, the overall market for A/E services in 2021 will undoubtedly be smaller, much more competitive, and dramatically different.

- The market contraction could well last into 2022, depending on the size of the hole the pandemic blows in state and municipal budgets, and timing of a COVID-19 vaccine. Today, scenario planning ranges from equally weighted worst cases to vaccine-delivered normalcy, and everything in between. (Warning: Don’t click the link if you like your Mondays filled with certainty.)

- Competition will be fierce – with former “friendly competitors” poaching each other’s clients and low-overhead firms under-bidding every project. QBS will once again be subject to interpretation (as it was during the Great Recession); the public sector will be running austerity budgets. The downward pressure on margins will be approaching Mariana Trench levels.

- The winners will be tech-enabled and tech-savvy. Clients will demand reliable, cost-efficient, user-friendly, forward-looking, and scalable digital solutions for the design, construction, and management of their infrastructure and environment assets. This trend was already in play and the crisis will accelerate it. Going forward, it will be acquisitions like this by Tetra Tech and investments like this by Ghafari that will separate the winners from the losers in the upcoming new reality.

- Compounding the challenges ahead for the industry will be the fact that the economic pain in the country will be felt in every household including those of A/E and environmental professionals and technical staff. This will result in internal ownership plans failing as stock purchases will fall short— crowded out by other personal financial needs. The slow decline of the employee-owned A/E firm will accelerate over the next two years.

- How long does the industry have before the New Reality is here? It depends. The largest firms tend to have biggest projects, the longest-funded backlogs, and access to better credit facilities. Their management teams have one to two years to make the necessary changes and investments to survive the downturn and thrive on the other side. At the other end of the spectrum are smaller firms that in the good times may have had 90 days of backlog, although by now, it may have dwindled to just 60 days. That, plus a PPP loan that has almost expired plus cash in the bank, buys them to the end of 2020 until their New Reality is upon them.

- Now officially a “thing” is firms paying for employees to adapt their houses or condos or apartments to make remote working smoother. If you’re an A-player there’s never been a better time to get some home remodeling done – courtesy of your employer.

- Virtual project interviews, team meetings, and reviews are now the norm and will likely be a big part of the post-pandemic project winning and review environment. If you have not made this mind shift, you’re already losing out.

- Digital marketing and business development represent the next frontier for many – since it’s going to be hard to take clients to sporting events or meet them for dinners. Smarter firms have already embraced the digital marketing and business development world, recognizing that young decision-makers and owners use the Internet to find, engage, and work with their A/E consultants. Google will become increasingly vital to your digital marketing (in addition to researching what “digital marketing” means.)

Regional insights

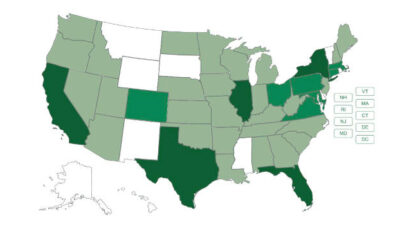

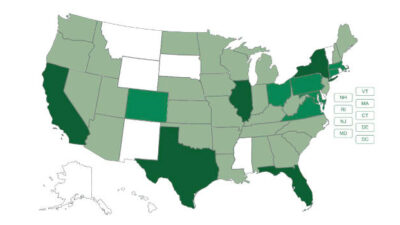

- West Coast vibes are trending positive. Infrastructure and development backlogs remain strong and firms are hiring— in some cases, aggressively. Many firms are reopening offices over the next couple of weeks in Arizona and Northern California. Positive reports also in civic/government, life sciences and technology, and education sectors.

- Mountain and Plains states development, power, renewables and water infrastructure markets continue with a pioneering sense of optimism. Architecture and engineering firms are busy and hiring.

- Many Midwest markets report a similar strong business environment with public-sector clients taking advantage of lower funding and construction costs to advance capital projects.

- Texas infrastructure and development markets continue to be as “hot as a biscuit” with A/E firm workloads, backlog, and balance sheets strong.

- Southeast markets also remaining sunny with good activity in many sectors, including residential, mixed-use development, and healthcare. Senior living markets in Florida continue to be robust— if somewhat changed— as more seniors are looking to live alone rather than in communities. Phased returns to offices are proceeding. Many firms plan to have at least 50% of their workforce back in offices by end of July.

- New England, New York, and Mid-Atlantic transportation and water infrastructure firms are busy and winning plenty of new work. This infrastructure work cannot be delayed any longer in many cases. Multiple reports of commercial and residential development projects continuing on track and new projects out to bid.

Mergers & acquisitions insights

- Industry consolidation has slowed. Year-over-year the pace of industry M&A is down 12%. But this slowdown is totally different than what we saw happen during the Great Recession.

- Expect an uptick in deals this Summer as economies reopen, buyers get a better read on the market and close on deals that they deferred in March, and sellers can refocus on deals after moving their employees to a remote working environment (and in some cases back again). Our current reading is that deals may fall 20% this year— back to 2015 levels. However, valuations are continuing to hold up in general.

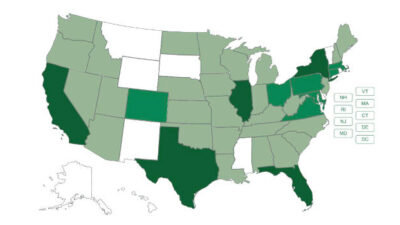

- Expect to see more deals in states that have not been hit as bad by the pandemic. So, we’re expecting to see relatively more deals in states this year and next in states like North and South Dakota, Montana, Wyoming, and Idaho.

The pandemic has changed how mergers and acquisitions get done in the industry. The M&A landscape is in flux and questions abound.

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.