Morrissey Goodale is providing A/E leaders with news on the coronavirus and its impact on the industry. Highlights this week include a roundup on the general impact of the economy and a take on the post-coronavirus AEC industry.

Morrissey Goodale is providing A/E leaders with news and perspective on the coronavirus and its impact on the industry.

COVID-19 UPDATE

A first take on the post-coronavirus AEC industry

The coronavirus pandemic has created a dual public health and economic crisis unlike anything seen in our lifetimes. The AEC industry has responded to the biggest global challenge since World War II in various ways, including 3-D printing protective gear for first responders and designing modular healthcare centers.

No one knows how long this crisis will last. Even if the COVID-19 outbreak subsides over the summer, it’s possible that recurrences could require further rounds of stay-at-home orders until a vaccine is finally developed. One thing that’s apparent by now, however, is that there won’t be a return to “normal.” With such a world-changing event, there will be wide ripple effects presenting both future threats and opportunities. Here is an early glimpse at what the AEC industry’s “new normal” might look like once the recovery begins:

Negotiating the curve. As the pandemic recedes, talk of “flattening the curve” will be replaced by discussion of the shape of the economic rebound’s curve. Dr. Anthony Fauci, the country’s leading infectious disease expert, has warned that the recovery process will not be like flipping a “light switch.” The economic contraction has been extremely steep. The longer that stay-at-home orders persist, the less likely that there will be a quick, V-shaped rebound and the more likely that there will be a slower, flatter U-shaped recovery instead.

Market watch. The pandemic’s economic fallout is expected to be the worst in markets most impacted by social distancing such as hospitality, entertainment, retail (with the exception of grocery stores), and aviation. Healthcare and public works markets are expected to see an uptick in activity. State departments of transportation and municipal agencies have already begun accelerating design projects to get them shovel-ready in preparation for a massive infrastructure stimulus bill. Although repeated hopes for an infrastructure bill during the Trump administration have not come to fruition, a recession might change that. A federal boost will be badly needed as states are seeing tax revenue plummet as virus-related spending soars.

Think local. “There will be a rethink of how much any country wants to be reliant on any other country,” Elizabeth Economy, a senior fellow at the Council on Foreign Relations, told the New York Times about the impact of the coronavirus on globalization. The pandemic will further strengthen movements around the world to restrict immigration and raise trade barriers. Working on global projects will be made more complicated, but opportunities may arise with companies previously dependent on global supply chains that now need to construct domestic facilities to provide redundancy.

Urban flight? America’s most densely populated cities proved the most vulnerable to the pandemic. It bears watching as to whether attitudes about living and working in close quarters in a post-coronavirus world will change and whether there might be a reversal of the recent urban renaissance. If density is feared, employers and residents might gravitate to suburban locations and the trend of establishing downtown office locations to attract younger employees could stall.

Designing solutions. Design firms will have an important role to play in preventing future pandemics. “Buildings have to be the secret weapon in the future to combat infectious diseases,” Luke Leung, director of sustainable engineering at SOM, told Fast Company. Design solutions that might be in demand could include increased hand-washing facilities, thermal imaging to monitor temperatures, and reducing the need for building users to touch communal and contaminated surfaces. Think elevator buttons and light switches. Highly rated filters and ultraviolet lighting incorporated into HVAC systems could assist with killing common germs.

Keeping distant. Some level of social distancing will be required in many areas of the country at least until a vaccine is available, which could be 12 to 18 months away or even longer. Design responses might include the erection of more partitions in public spaces, the widening of corridors and doorways, and the elimination of bottlenecks where crowds form, such as at airport security screening posts.

Office space. A growing backlash to open office concepts will likely accelerate in a post-coronavirus world. Social distancing practices may mandate more space per person and increased partitions in office spaces, which will require design services for reconfigurations. Reductions in maximum occupancies for elevators and lobbies would impact skyscraper and office building designs. Companies may seek to replace large central offices with several smaller satellite locations to produce greater redundancies inside their organizations.

The virtual life. Forced to vacate offices and move online in order to survive, firms that held out on having remote workforces won’t be able to turn back. Companies that have operated without the physical presence of workers for months will find it difficult to tell employees and potential hires in the future that they cannot work at home. Virtual interviews and on-boarding of new talent will be required, and the work-from-home trend will result in companies requiring less office space.

Strategic M&A opportunities. The coronavirus crisis put the brakes on the record-setting pace of AEC industry mergers and acquisitions to start 2020. Firms with infrastructure, public works, and healthcare specialties will be attractive targets once the recovery begins. In the short term, private-equity backed buyers attracted by lowered valuations will continue to engage sellers, make offers, and close deals so that the combined businesses will be ready to take advantage of the recovery.

Vital communications. Your employees and clients are grappling with fear and uncertainty. Make sure you are in constant communication with your workforce to address any concerns they may have. Alleviate any of their fears and lend encouragement, but be straight with them. Talk constantly to your clients, find out what their needs are, and be relentlessly helpful. Design firms that are responsive to their clients’ needs will be better positioned in the recovery phase. Make your firm indispensable to your clients’ coronavirus recovery plans

Word on the street

Real-time market and industry intelligence during the COVID-19 crisis

A weekly sampling of what the Morrissey Goodale team is hearing from A/E leaders around the country and seeing in our strategy, M&A and executive search work.

Summary:

It’s a mixed bag by region and market – but the industry is holding up well overall in the short term – with concerns about what happens next

National industry news

- Industry moving from “how on earth can we work remotely?” phase to “what’s next?” phase.

- Many firms have received PPP loans providing an immediate boost to morale. However, for firms considering a sale PPP loans could complicate matters down the road.

- Having moved successfully to remote working teams are now getting video-call-fatigue and want to get out of the house. Multiple reports that firm utilization rates are WAY up with remote working model (6% plus). Who would have known we’d miss our commutes so much?

- Backlogs remaining strong in general. Reports of backlogs GROWING over the past week in public infrastructure (water and transportation) , power generation and certain buildings markets including communications and networking. Many firms went into March with record backlogs after record sales in 2019.

- Industrial markets holding up well. Reports from around the country indicate that industrial projects continue largely unaffected.

- Numerous industry firms are at the cutting edge fighting the virus. A great example is the partnership between IMEG, HGA and Boldt. Strong demand for design and environmental services in COVID-impacted healthcare.

- Cargo aviation design and construction projects surging. Driven by “last mile” demand. Different story for new commercial and passenger projects.

- Pencils down notices in entertainment, hospitality, corporate, and retail markets are becoming more common.

- Commercial and residential development projects nationwide are continuing but at a less frenetic pace. Some regional stops and slowdowns.

- Some DOTs cancelling projects as drop in revenues from less traffic impacts their budgets.

- Hiring freezes in place at many firms nationally through at least mid-May – except for exceptional talent.

- A number of firms leveraging the crisis to cut under-performing managers. This follows the precedent set in the 2008/2009 recession.

- Industry M&A down 6%.

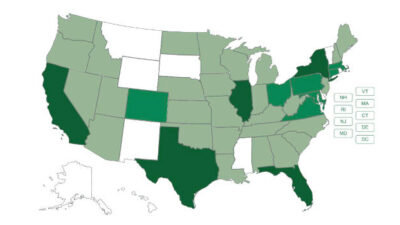

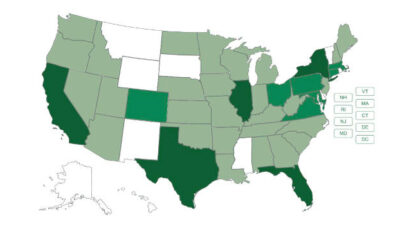

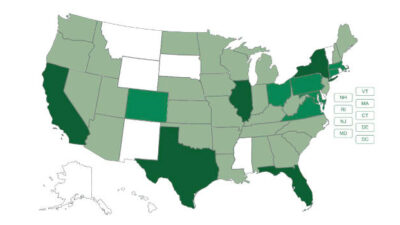

Northeast markets

- Non-essential construction stoppages in the Northeast and Mid-Atlantic leading to substantial layoffs and furloughs.

- Northeast being hit harder than rest of the country with NY, NJ and PA not including engineers as essential services.

Midwest markets

- Residential and commercial development proceeding but slightly slower pace.

- Recent Wisconsin election provides for robust funding for education projects.

- Major metro communications markets continue unaffected for now.

- Capital improvement projects are continuing with unchanged outlook for 3 to 6 months.

South and Southeast markets

- South Florida municipal facilities markets continue unaffected. North Florida land development projects still moving.

- Central and South Florida multi-family and senior living markets continuing strong.

- Reports of North Carolina, Alabama and Mississippi DOTs postponing or cancelling projects. Fewer motorists on roads leading to reduced revenues impacting budgets.

- Reports of hospitals and universities curtailing design and construction budgets.

Texas

- Public infrastructure and development markets holding up well. Firms remaining super busy. Some delays in RFPs and RFQs.

- Austin loosening restrictions on construction work.

- Some pull-backs and slowdowns in hospitality and entertainment.

- Some slow downs with universities.

West coast

- Multiple reports of healthcare and laboratory design projects moving forward.

- Reports that AZ and CA private development continues to be strong – particularly Phoenix.

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.