Building commissioning providers are closely tracking the business, market, and technical trends that are influencing—and, in some cases, reshaping—their profession. At the top of the list are priorities that affect practical business decisions, both near-term and in the future.

Learning objectives:

- Introduce the top commissioning professionals, including the 2016 Commissioning Giants.

- Explain the commissioning business model’s future and top business issues and expectations according to commissioning providers.

A recent study of commissioning industry stakeholders, conducted by the Building Commissioning Association (BCxA) shows that strategic and technical problems, needs, and outcomes are expected to shift the structure and function of the commissioning business model over the next 5 years and beyond.

Let’s be honest. For every business in every sector, it is about the money. Beyond that, it’s about value and results that last. Commissioning providers (CxPs) are finding themselves in the role of liaisons who connect silos of designers, builders, and owners’ personnel to deliver the promise of value and increasingly over time, a valuable (but not always valued) position.

In an effort to define what’s going on behind the scenes of daily contract fulfillment, field work, and forensics, the Building Commissioning Association (BCxA) reached out to commissioning providers and stakeholders to understand the top pressing business issues they foresee. A further technical online survey correlated both sets of information to gain a full picture of commissioning concerns and expectations.

The initial investigation included mostly CxPs with a sprinkling of designers, builders, owners, and facilities staff, representing six 1-hour mixed focus groups and an online business-focused survey. Attendees (BCxA members and nonmembers) were asked to describe their concerns over three separate time frames.

- One year: The main concern over the next 12 months is arresting the commoditization of the commissioning market, whereas previous BCxA surveys indicated that training was the primary need. The second most important concern is creating targeted value propositions for commissioning and disseminating to appropriate audiences.

- Two to 4 years: The biggest concern is identifying opportunities to grow the Cx business, followed closely by ensuring best practices are applied consistently across the Cx profession.

- Five or more years: Two major concerns over the long term include succession planning and commissioning teams prepared for deeper engagement in building performance. Predominantly, outcomes were predicated on thinking through the long-term business model for the practice of commissioning and understanding the impact of shifts in design, construction, and operations on the practice of commissioning.

The top 10 business issues described by respondents are listed below for each time frame, representing challenges or solutions for CxPs and their clients to achieve the best value in project delivery.

Business issues for CxPs

Problems to solve within the next year: commoditization and value proposition

- Commoditization vs. quality performance

- Selling owners a clear, unquestionable value proposition, including ways to add value

- Educating owners and managers about commissioning content, process, timing, and benefits

- Recruiting qualified staff

- Integrating project teams and improving communication skills

- Scaling commissioning for projects of all sizes

- Creating consistent contract documents written for the commissioning profession

- Working to mitigate the negative impact of codes that undermine Cx best practices

- Developing a consistent approach and expectations for Cx in the private sector; reducing jurisdictional differences in the public sector

- Building performance criteria into design team deliverables.

Two to 4 years: Needs to fill, opportunities to grow, and best practices

- Expanding company capabilities, such as bringing building-enclosure commissioning (BECx) in-house

- Integrating consistent best practices in design and delivery plans, expectations, and implementation among all players

- Formally educating allied professionals on the benefits they accrue from commissioning

- Developing tools to support continuous teamwork throughout the design-delivery process

- Finding ways to recruit as well as develop advanced skills among younger staff

- Creating resources to educate CxPs on the new wave of building technologies and validation tools

- Purging "check-the-box" and "drive-by" commissioning providers from the profession

- Increasing the focus on whole-building commissioning (WBCx)-beyond energy efficiency

- Improving project assignment manpower forecasting capabilities

- Focusing on "occupied optimization" of buildings.

Five or more years: outcomes to achieve; long-term business model

- Best practices carried farther into the industry, without being watered down, to realize the true value of commissioning

- Succession planning underway to replace the aging market: mentoring the next generation of commissioning leaders who are looking for increased work/life balance

- Prepared teams for existing building commissioning that includes deep energy retrofits, distributed energy, systems interoperability, and integrated building information-management systems

- Updated study on commissioning data to help CxPs establish and explain value-costs and benefits similar to the 2009 LBNL Study by Evan Mills

- Streamlined methods to integrate new technologies with legacy systems

- Commissioning curriculum offered in college and university programs

- Expanded and diversified commissioning education that concentrates on the high skills needed for complex buildings, future smart grid issues, demand response, self-generation, energy-recovery systems, microgrids and renewables, net zero, and associated operational complexity

- Integrated technical adaptation in step with goals, such as the Architecture 2030 Challenge

- Next-generation utility, government, and private sector programs implemented to facilitate superior building performance through commissioning

- Adequate workforce capacity to design, build, commission, and operate at an upscale level.

Best practices for technology issues

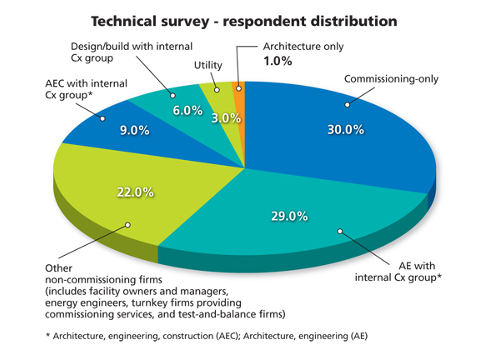

A second data set, an online survey of CxP firms and associated technical service providers, was correlated with the business-focused responses above. This “best practices” survey yielded more than 300 responses about priorities for technology advancements, practical tools and automation, market conditions, and training topics to meet future building needs. Respondents represented commissioning practices across the U.S. and Canada. Survey respondents’ distribution is shown in Figure 1.

Respondents were asked to define what the commissioning industry could do better to make their technical performance more productive. Rather than rating or weighting a predefined list of topics, the BCxA asked for open responses in order to understand what CxPs care most about and believe would improve their career. Respondents answered that they would like to see the following self-identified improvements, ranked in descending order by category count (number of mentions per category). The list below shows the top five improvement wish list items along with examples of respondents’ recommended actions:

Team/role:

- Ensure early communication with general contractor/construction manager

- Create opportunity for more input on project specifications due to deep experience with diverse systems and integration

- Clearly establish and standardize functions/roles of commissioning and CxPs

- Sort out and agree upon lines of responsibility throughout project

- Improve document coordination with non-Cx entities

- Coordinate all project teams early.

Standards and guidelines:

- Develop testing standards

- Establish a five-step process guideline to support enhanced commissioning on new construction 1 to 2 years post-occupancy

- Improve the definition of standards for commissioning results

- Create consistent methods for owners to compare providers

- Create a commissioning-community database for industry-standard templates and other documents

- Use common nomenclature.

Quality:

- Define and hold up higher standards for levels of care

- Regulate and audit commissioning outcomes to ensure a minimum standard of acceptance.

Certification:

- Consolidate to make a single, standardized, accredited certification mandatory as a professional qualification so that fraudulent commissioning firms can be audited and exposed

- Market awareness: emphasize the value of accredited certification.

Training and education:

- Respondents identified training and education among the top five improvements the industry could take on to improve commissioning. Figure 2 illustrates results regarding the need for further training and education within various parts of the overall commissioning industry.

The table indicates that CxPs are looking to the industry for significant changes and improvements to sustain their professional standing as the market launches new strategies for efficiency and broader, deeper systems integration and ongoing value over the building lifecycle. There was a strong desire among CxPs calling for the establishment of consolidation and uniformity in many areas of commissioning practice. While it’s true that most are calling for standardization in tools and practices, respondents simultaneously want more independence and a higher level of contribution within the building industry. CxPs are broadening services beyond a construction-focused quality assurance process and are—or want to be—increasingly involved in occupancy-phase building performance.

Beyond the top five areas of improvement cited by respondents, specific actions are recommended for deliverables, commissioning tools, codes, scope-of-work expansion, procurement, and marketing/advocacy. The BCxA is reviewing action items for their potential integration into member services.

Contradictory opinions abound among commissioning providers, which is normal for most professional services. There is also disparity between (1) desired areas of improvement for productivity and (2) priorities for additional training and education. For example, respondents prioritize project team relationships and role clarification at the top of the productivity improvement wish list, but consider building systems and assemblies the highest priority for training.

Based on overall responses from the BCxA’s focus groups and surveys, together representing more than 500 respondents, the following business and technical concerns are considered high priorities over the next 5 or more years.

- Arresting the commoditization of commissioning

- Creating value propositions for various types of owners

- Identifying commissioning business growth opportunities

- Ensuring best practices are applied consistently by all in the profession

- Building the long-term business model for the practice of Cx

- Keeping pace with shifts in the overall design and construction industry.

The commissioning profession is becoming more complex. The commissioning business model is encountering the burden of losing experienced problem solvers, some of whom are not adapting to market pressures. At the same time, companies are vigorously seeking smart recruits with personal and technical skills, most of whom have not earned the experience or insight to troubleshoot and verify building systems and performance. Succession and continuity planning are of the essence.

CxPs are looking for more teamwork and integrated coordination among project personnel that allow for complementary, rather than competing, roles in successful project delivery. CxPs have synthesized knowledge and experience across numerous projects and systems and are a valuable resource for owners, design teams, and construction managers. With the increasing focus on efficiency over the building lifecycle, CxPs want deeper involvement in post-occupancy performance and the profitability that goes with it.

The commissioning value promise is and always will be quality assurance. Opportunities to expand the CxP’s role abound as the building industry and its drivers—codes, regulatory requirements, technologies, performance expectations—become more exacting, durable, and lasting. The future is on the way, and everyone has a stake in it. Make it valuable.

Diana Bjornskov is the senior program manager at the Building Commissioning Association. She has spent more than 30 years in the building industry with extensive experience leading research and analysis of building industry issues, energy policy and legislation, market-potential assessment, and program planning.