Morrissey Goodale is providing A/E leaders with news and perspective on COVID-19 and its impact on the industry. This week, they discuss the outlook for 2021 and how industries will adapt.

Morrissey Goodale is providing A/E leaders with news and perspective on COVID-19 and its impact on the industry. This week, they discuss what is worrying A/E CEOs this fall and how they’re trying to overcome their anxieties.

Place your bets for 2021

Next year’s outlook for the A/E industry is – to put it delicately – challenging. Non-residential buildings construction is expected to contract 5%. State and municipal budgets will see revenue shortfalls comparable to the Great Recession. Combined, these speak to a smaller market for A/E & environmental consulting services with plenty of potential for downward pressure on margins.

While the overall market will contract in 2021, there will be opportunities for growth. Some of these will be in existing sectors. Others will be in new “markets” created by the pandemic.

So even though Las Vegas casinos are hurting these days, A/E leadership teams are busy placing their bets on where to invest for growth in 2021. But assessing market opportunities and creating pursuit plans for next year is going to a very different exercise than in the past.

The pandemic has remade every market. So leadership teams are compelled to view markets through a completely different lens than they did pre-COVID. For instance, commercial and retail markets over the last decade consisted largely of delivering services to support new and expanding developments with ample opportunities for a wide variety of architecture, civil, and site development firms. However, in 2021, the opportunities for growth in this market will accrue to design firms that understand how to repurpose and redesign existing commercial properties and facilities to safely engage with customers and tenants.

The pandemic also complicates market analysis for 2021. Facility design considerations and market demands will change markedly over the course of 2021 as owners move from a pre-vaccine decision-making environment to a (hopefully) post-vaccine one. In the past, leadership teams could make assumptions about the “steady state” of any particular market for a 12-month, or longer, period – not so in 2021. Uncertainty around the post-election socio-political environment further complicates market analysis for the upcoming year.

Leadership teams need to focus on two leading indicators for a successful 2021. First, they need listen to what their clients are saying about how their fortunes are changing. Second, they need to look at the macro socio-economic trends that are playing out. Connecting both of these dots will allow teams to better use this 4th quarter of 2020 to position for success in growth markets in 2021 and exit out of losing positions. So where are some of the growth markets next year?

All things “housing” will continue to thrive through 2021. This market continues to be hot as a biscuit. The combination of low mortgage rates, a crisis of supply, and pandemic-driven migration to suburban and rural areas provides ample tail winds well into 2021. The major risk to the market is if the unemployment rate remains stubbornly high. This market will provide growth opportunities for regional and local design and consulting engineering firms and also for some of the nation’s largest architectural designers that have multi-family or mixed-use portfolios.

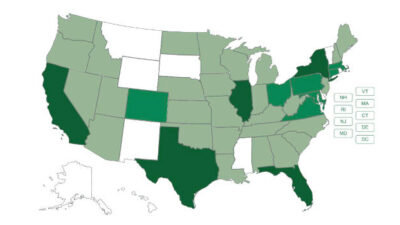

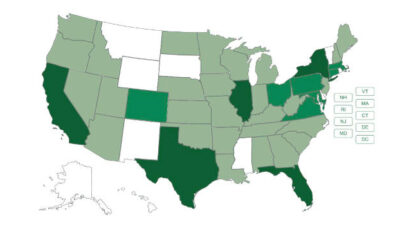

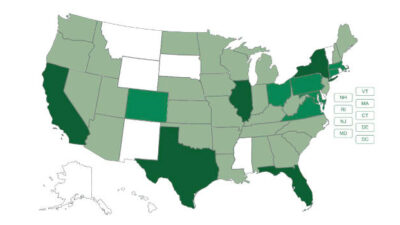

Some states and municipalities will fare better than others. Initial estimates of state revenue shortfalls vary widely – from approximately 4% in Iowa to 16% in Hawaii. Some states – like Texas – were in a stronger fiscal condition prior to the arrival of COVID compared with states like Illinois. Depending on the composition of their tax base, certain cities will be hit harder than others. Public works and other spending in relatively stronger states and municipalities will favor firms on the ground there. Out-of-state firms will likely need to acquire or open an office to access the work.

By and large, the federal markets will continue to be robust. Unlike most states and municipalities, the federal government is not required to have a balanced budget. This massive purchaser of A/E & environmental services will continue to roll on in 2021. Federal spending priorities, however, will change if there is a change in administration. Access to the federal market is largely reserved for the largest industry players, firms with deep-dive expertise, or those with SBE or other special designations and security clearances.

Life sciences will boom. This sector has attracted billions in venture and institutional investments in 2020 which is driving a boom in the development of R&D facilities – in cities and on university campuses – that will last well beyond 2021. This sector will provide tremendous backlog for specialized architectural, MEP, refrigeration, and structural designers.

Industry and manufacturing to reshore. The pandemic exposed major weaknesses in global supply chains and has prompted manufacturers to accelerate plans to reshore production and sourcing back to North America. This will favor industrial engineering firms and R&D facility designers – especially in those with a footprint in the Southern and Southeast states such as Alabama and South Carolina that are friendly to industry and manufacturing.

Warehouses and distribution centers will be in demand. The pandemic has served to accelerate the move to on-line retail. Amazon is opening 100 distribution centers just this month. On-line retailers will drive strong demand for A/E and environmental services in this sector and associated cargo facilities at airports through 2021 across North America.

Data centers will be needed to support growing technology. Closely related to the movement to on-line retailing and everything tech is the power to process all of the data necessary for its success. Design and development of data centers will be another growth market in 2021, benefitting A/E, MEP, and site development firms.

Environmental health & safety (EHS) will impact value of facility assets. Facility owners and managers will continue to see EHS – both pre- and post-vaccine – as critical to the successful marketing and operations of their assets. Big winners here in 2021 will be environmental consulting and management firms that can deliver accurate analysis and scalable and reliable solutions across regional and national facility portfolios.

Where government budgets fall, look for government privatization and outsourcing to rise. Much like we saw through and after the Great Recession, budget shortfalls will create incentives for state and local governments to privatize and outsource services. This trend will create growth opportunities for consulting engineering and environmental consulting firms with technology and proprietary software offerings.

Meanwhile, industry M&A continues to rebound to pre-pandemic levels. With much of the activity involving firms serving growth markets. M&A is down just 9% over last year’s record-breaking pace.

This article originally appeared on Morrissey Goodale’s website. Morrissey Goodale is a CFE Media content partner.